Common Bookkeeping Mistakes in Construction and Trade Industries: What You Need to Know

In the realm of construction and specialty trades—whether it’s plumbing, electrical work, or HVAC systems—effective Bookkeeping is paramount. Over the years, I’ve immersed myself in understanding how professionals in these fields manage their financial records, and I’ve discovered that their Bookkeeping challenges significantly differ from those of many other industries.

One of the most pressing issues that tend to arise in these sectors is related to job costing. Accurately determining the costs associated with a specific project, including labor, materials, and overhead, is crucial. Yet, many tradespeople struggle to maintain a clear distinction between these expenses, which can lead to inaccurate financial assessments and, ultimately, profit loss.

Another frequent challenge is the tracking of materials against labor costs. Trade professionals often face difficulties in monitoring how much they invest in supplies versus the labor hours spent on a project. This oversight can skew budget projections and impact pricing strategies.

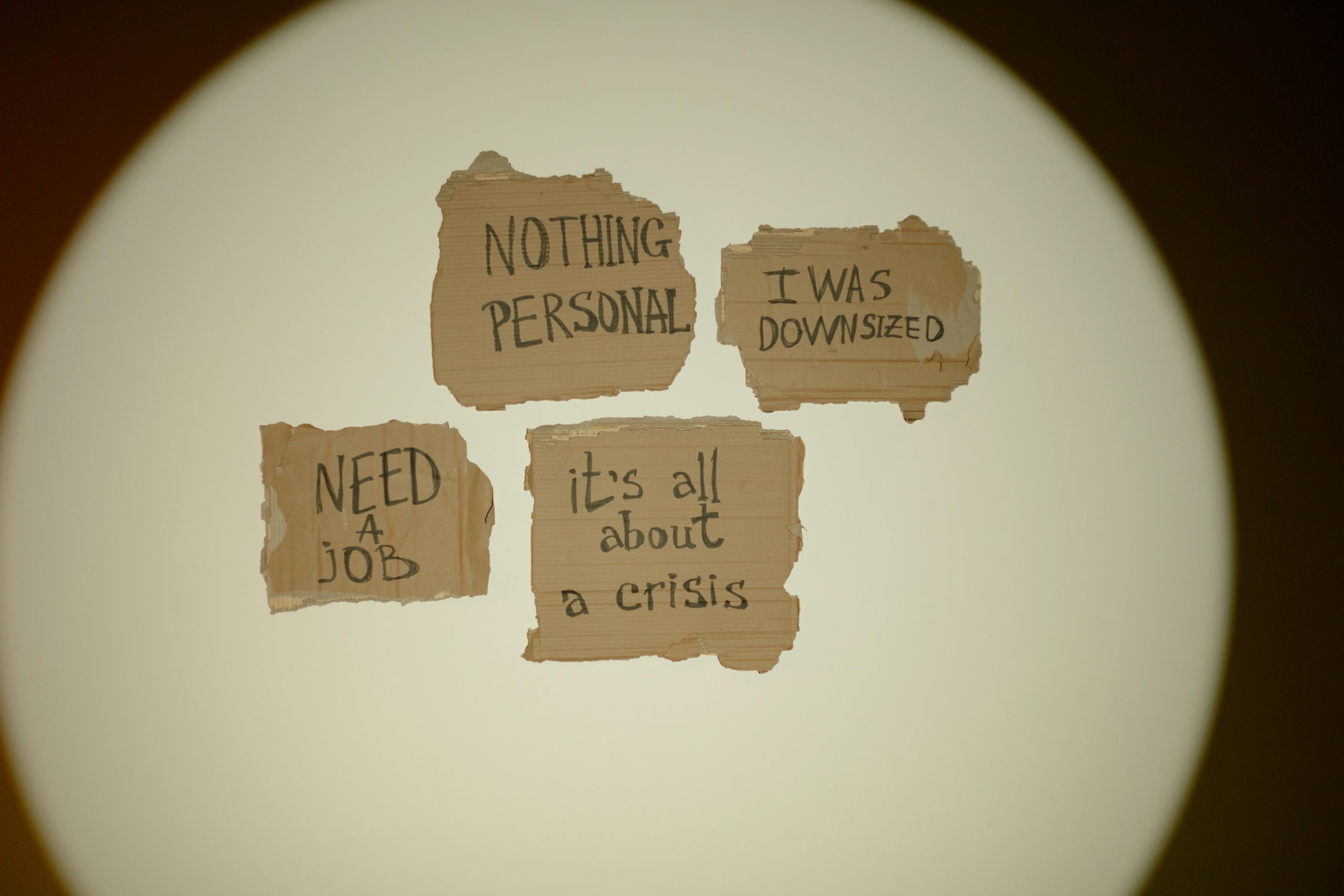

Moreover, the issue of delayed payments adds another layer of complexity. Many tradespeople encounter slow payment cycles from clients, which can disrupt cash flow. Without an efficient system in place to manage invoices and payments, it’s easy for financial discrepancies to emerge, exacerbating the overall bookkeeping challenges.

I would love to hear from others in the industry. What do you consider the most common or detrimental mistakes in bookkeeping for construction and trade businesses? How do you navigate these challenges to ensure accuracy and maintain financial health? Your insights would be invaluable in shedding light on this important topic!

No responses yet