To become a corporate raider like the characters Larry the Liquidator or Gordon Gekko from the movie Wall Street, you need to follow a series of strategic steps, while also being fully aware of the ethical and legal implications of such actions:

Understand the Role: A corporate raider typically seeks to purchase significant stakes in undervalued or poorly managed companies, aiming to gain control and either restructure or liquidate for profit. This often involves aggressive takeover tactics and in-depth knowledge of financial markets.

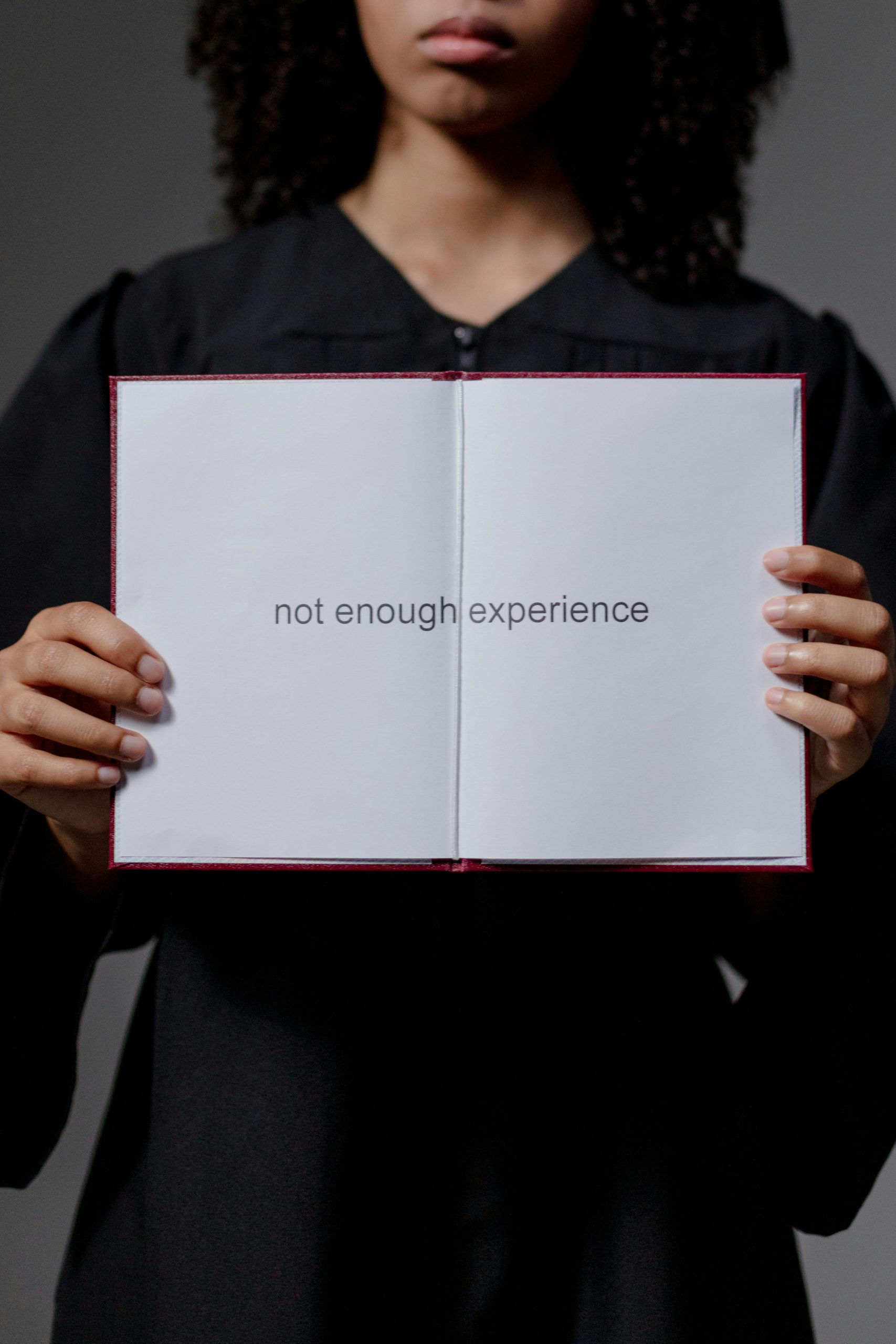

Financial Education and Expertise: Acquiring a strong educational background in finance, business, or Economics is essential. A degree in these fields, accompanied by a deep understanding of mergers and acquisitions, corporate finance, and securities laws, will provide a solid foundation.

Develop Analytical Skills: Being able to analyze financial statements, market trends, and the overall economic environment is crucial. This includes evaluating a company’s assets, liabilities, and potential for profit enhancement or turnaround.

Gain Experience in finance: Work experience in investment banking, private equity, or hedge funds can be invaluable. This experience will equip you with the necessary financial acumen, risk assessment capabilities, and industry contacts.

Build Capital and Form Alliances: Corporate raiding requires significant financial resources. This may involve forming strategic alliances with investors, forming syndicates, or creating an investment fund focused on identifying and executing hostile takeovers.

Understand Legal and Regulatory Frameworks: Corporate raiding operates within a complex legal environment. Ensuring compliance with securities regulations, anti-trust laws, and understanding proxy battles and shareholder rights is essential to avoid legal pitfalls.

Develop a Strong Ethical Compass: While the fictional characters often skirt ethical lines, in reality, maintaining an ethical approach is crucial. Corporate raiding can impact jobs and economies, so a responsible attitude toward stakeholders can protect your reputation.

Network and Build a Reputation: Networking with other financiers, legal experts, and corporate executives will provide insights and opportunities. Building a reputation for being a savvy, fair, and effective investor is crucial for long-term success.

Stay Informed and Adaptable: The financial landscape is constantly evolving. Keeping up with market trends, new financial instruments, and changes in regulatory requirements is necessary to stay competitive and effective in this role.

Cultivate Negotiation and Persuasion Skills: Being able to effectively negotiate deals, influence board members, and win over shareholders is crucial. Strong communication skills and the ability to present compelling business cases are vital components of any successful takeover strategy.

By strategically blending financial expertise, legal understanding, capital acquisition, and ethical considerations, one can potentially shape a successful career in corporate raiding, mindful of the high stakes and responsibilities involved.

No responses yet