Affordable Receipt Tracking Solutions for Small Churches

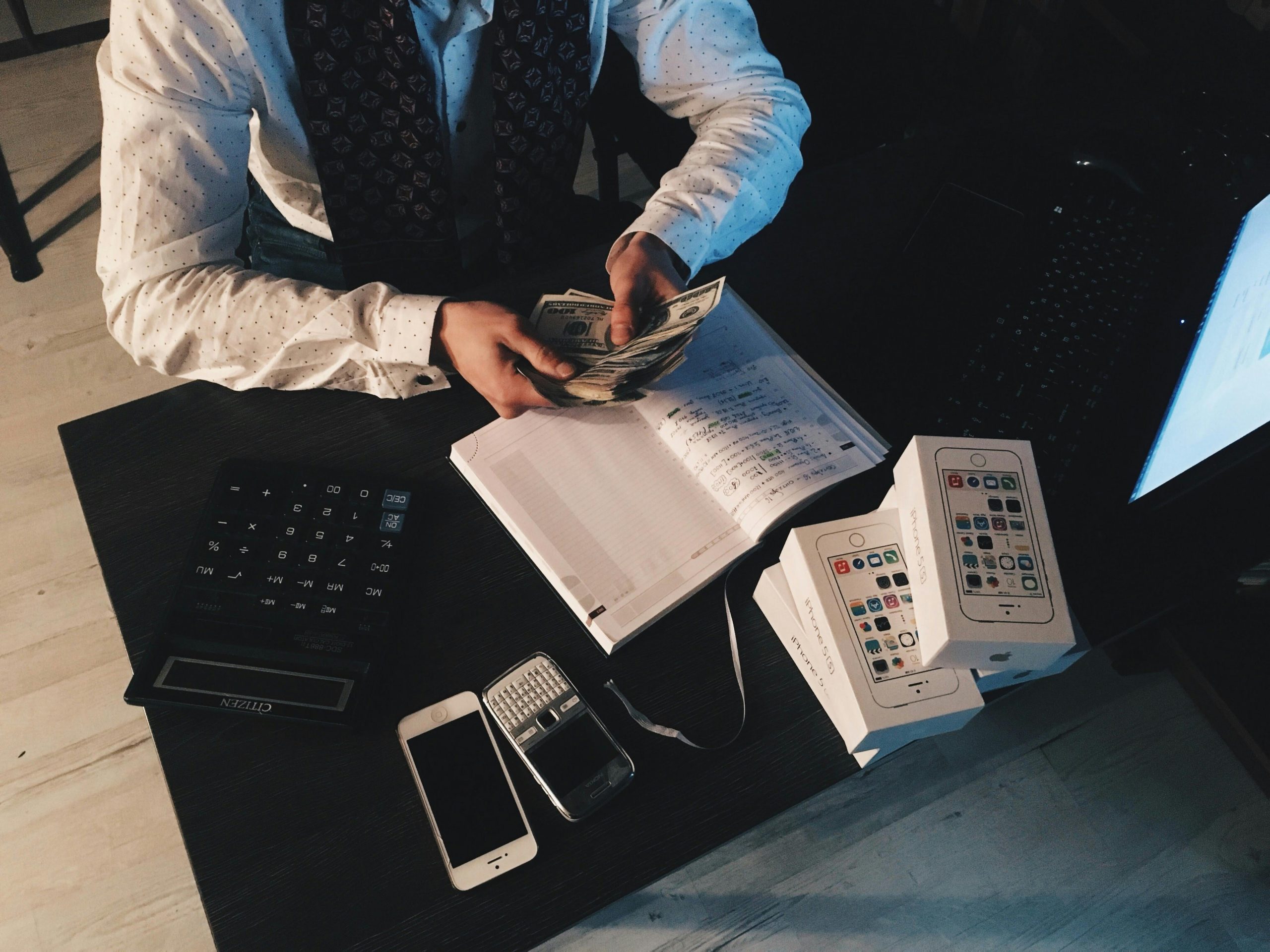

As we embrace technology to streamline processes, many small organizations, including churches, seek efficient ways to manage finances. One common challenge faced is the tracking of expenses, particularly concerning staff who hold credit cards linked to a shared account. Here’s an overview of a scenario encountered by one small church and some potential solutions to help simplify their receipt management.

The Current Process

At a small church with a dedicated team of 5 to 10 payroll employees, financial tracking relies on a traditional paper method. Employees currently log into their Chase Ink for Business accounts at the end of each month to manually compile a worksheet detailing their expenses. This process involves printing receipts, attaching them to the worksheet, and submitting it for approval to both the Accounting staff and a secondary approver. While this method does serve the purpose of monitoring expenditures and reducing the risk of fraud, it is undeniably cumbersome and time-consuming.

Seeking a Modern Solution

The goal is to find a cost-effective solution that allows employees to track expenses effortlessly. Ideally, a system that integrates seamlessly with their credit card accounts would enable staff to input receipts directly from their smartphones, similar to the convenience offered by American Express.

Currently, the church uses QuickBooks Online Plus for Accounting, which unfortunately does not link to their credit cards—only bank accounts are integrated. Although QuickBooks could provide a comprehensive solution, it may require each employee to have a separate account, and the Plus plan accommodates only three users. This limitation raises questions about user access and whether accounts can be restricted to solely add receipts to transactions.

Potential Solutions

-

Expense Management Apps: Investigate user-friendly expense management applications that link directly to credit cards. Many apps allow users to capture receipts via their mobile devices, simplifying the tracking process and ensuring easy access for approvals.

-

Integrating with QuickBooks: While QuickBooks does not currently link to the church’s credit cards, exploring the potential of integrating with a third-party application that can automatically sync expenses might be worthwhile. This could streamline data entry while complying with the existing financial oversight processes.

-

User Management Considerations: When selecting a solution, ensure that it offers robust user management features. Look for platforms that allow you to manage permissions, ensuring that employees can only submit receipts without granting unnecessary access to sensitive Accounting information.

-

Trial Period: Many solutions offer free trials. Consider testing a couple to determine which one best fits the church’s

No responses yet