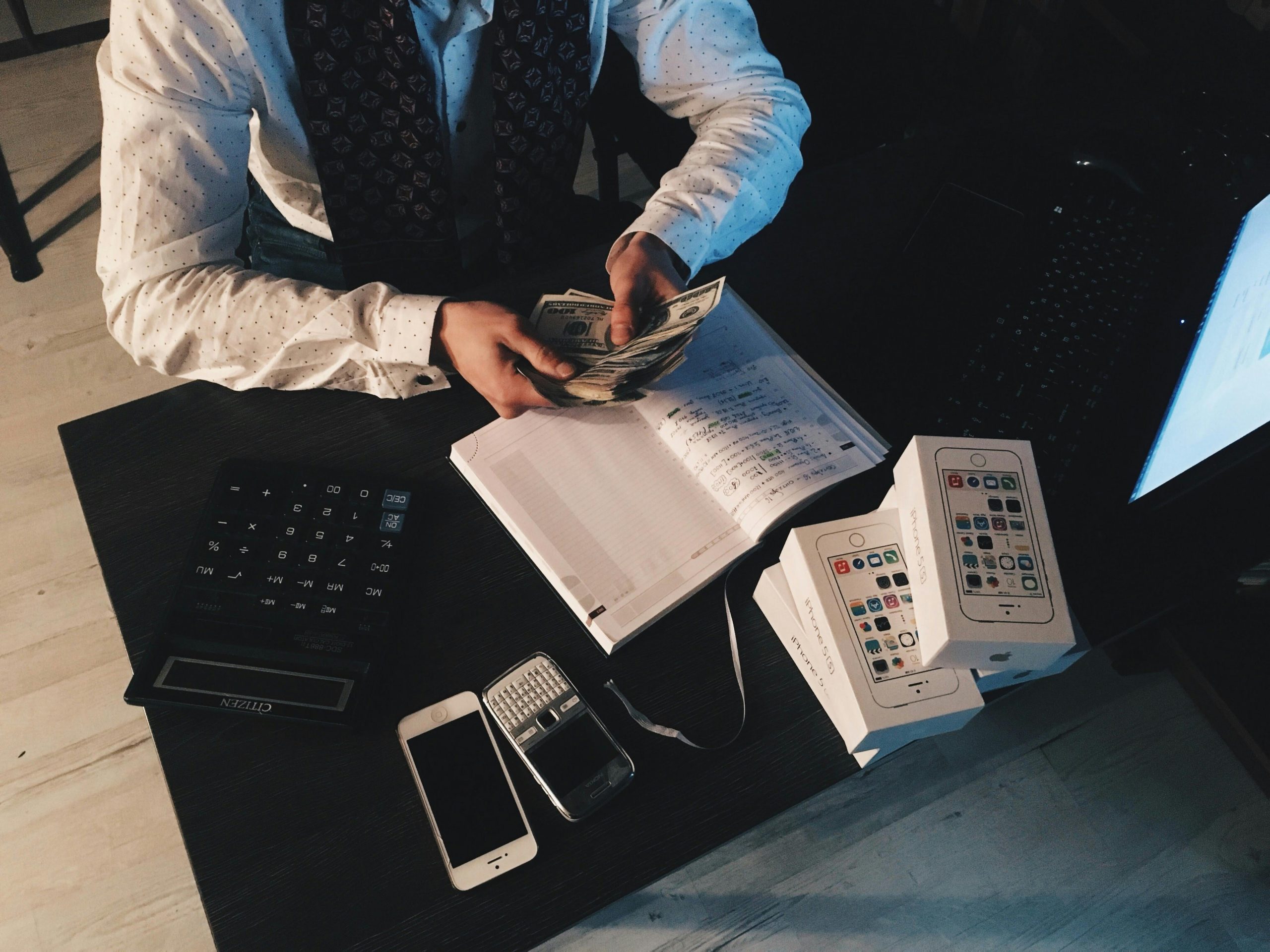

Simplifying Finances: Considering Outsourcing Bookkeeping for Your Small Business

Managing the financial aspects of a small business can often become a daunting task, especially as your revenue starts to grow. If you’re generating around $10,000 a month like many small business owners, you might find yourself stretched thin when it comes to managing Bookkeeping and payroll.

While I have been handling these tasks manually using QuickBooks, I’m reaching a point where the time commitment is becoming unmanageable—particularly with payroll, which consumes nearly two full days of my workweek. This includes recalculating hourly wages and generating invoices, which can detract from focusing on the growth of my business.

In order to alleviate this burden, I’m considering outsourcing Bookkeeping and payroll functions to a specialized service. In my research, I’ve found that local firms generally charge around $2,000 per month, which raises some important questions:

- What should I prioritize when selecting a bookkeeping service?

- Is the investment truly justified?

Having a dedicated team for these financial responsibilities could potentially free up my time, allowing me to concentrate on strategic initiatives that drive revenue growth. Additionally, I currently engage a freelance CPA during tax season, which has helped, but perhaps a more integrated approach could streamline my overall financial management.

I would love to hear from others who may have gone through a similar decision-making process. What factors did you consider? What has been your experience with outsourcing these functions? Your insights could be invaluable as I navigate this path toward more efficient operations.

Thank you for your support!

No responses yet