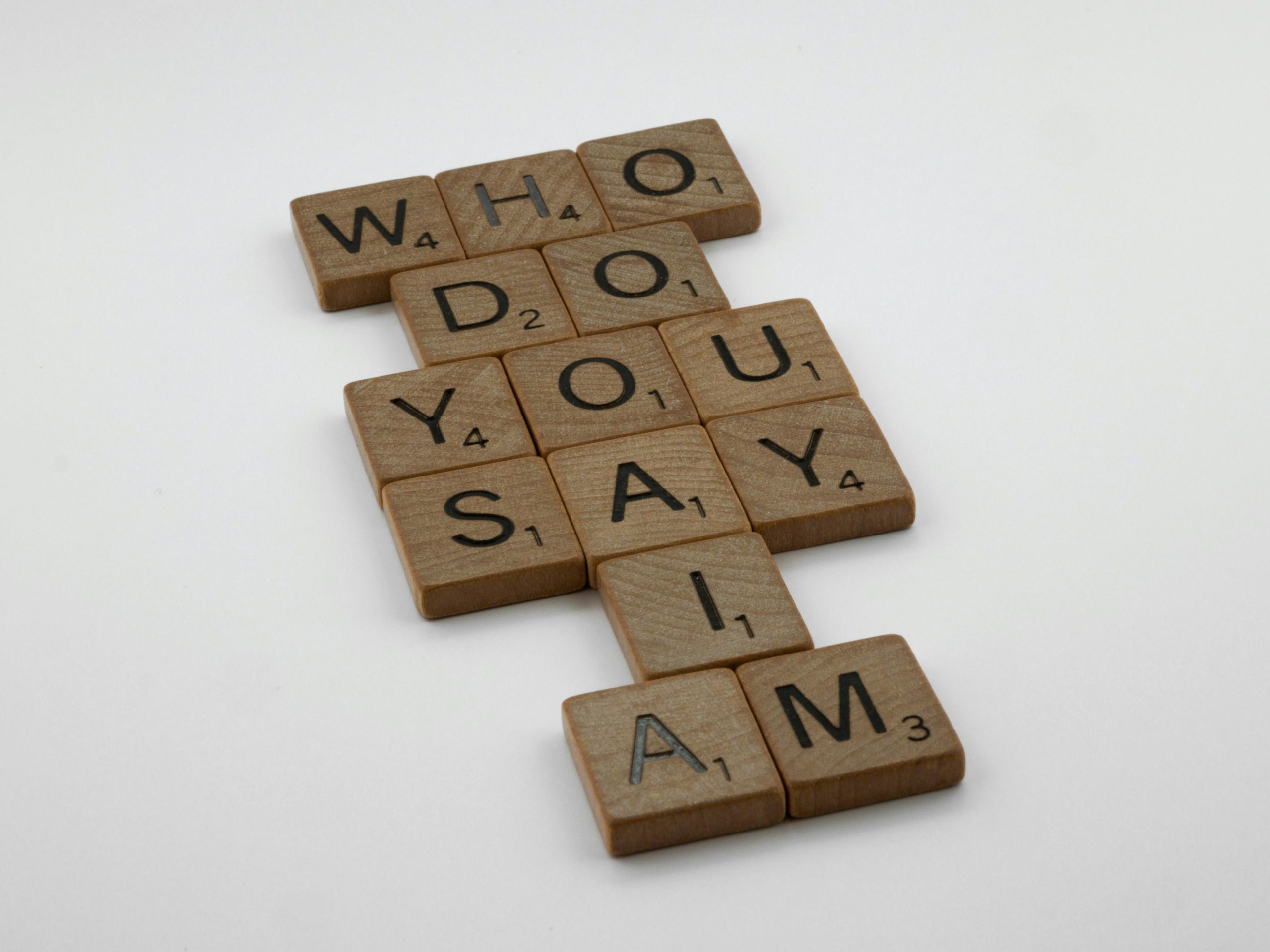

Exploring New Opportunities: Am I Just Chasing the “Grass is Greener”?

Hey everyone, I’m about 2.5 years into my first role, and while I truly enjoy it, I can’t shake the feeling that it’s becoming a bit too comfortable and laid-back.

I work as an allocator in the asset management division of a bank, overseeing a client book that mostly requires low-touch management. I follow our CIO’s investment strategies and only engage more actively with certain clients during our quarterly reviews. Aside from those busy periods, my day mostly involves account rebalancing, initiating trades and cash transfers, monitoring investment dashboards, and ensuring compliance. Honestly, I find myself “working” just 1-2 hours a day.

Currently, my salary is $85k, with a promotion likely coming in August.

However, I’m fully remote and feel like I might be missing the true experience of working in finance. I take my remote work responsibilities seriously, but I think I could benefit significantly from more social interactions and client engagement. In my first internship, even though I did minimal analytical work, I spent my days meeting clients, shadowing, attending dinners, and networking.

I’ve come across some wealth management roles in my area that offer slightly better pay but require being in the office full-time. I’m eager to improve my sales skills, and I believe these positions would blend my investment knowledge with the relationship-building experience I want to develop.

Am I making a mistake by considering a change? I also have some concerns about job-hopping in the current economic climate. What do you all think?

One response

It’s great that you’re thinking critically about your career and how to align it with your interests and goals! Here are a few points to consider as you weigh whether to hop roles:

Self-Assessment: Reflect on what aspects of your current job you enjoy and what you find lacking. If the social interaction and client-facing experience are significant to you, it makes sense to explore roles that provide that.

Career Growth: You’ve mentioned wanting to get better at sales and relationship skills. Moving into a role that emphasizes these areas could be beneficial for your long-term career. Wealth management positions can provide you with valuable experience and skills that are crucial in many finance careers.

Networking Opportunities: Being in a more social environment could enhance your professional network. This can be incredibly valuable not just for your current career but for future opportunities as well.

Market Trends: Consider the current job market and the stability of potential employers. If you feel confident in your research and they have a good reputation, it might be worth taking that leap.

Trial Run: If possible, look for opportunities to consult or freelance in wealth management or client-facing roles part-time while maintaining your current job. This will give you an idea if the new role is genuinely what you’re seeking without fully committing.

Long-Term Perspective: Think about where you want to be in 5-10 years. If client interaction and sales are key components of that vision, then a role change may align better with your long-term goals.

Ultimately, trust your instincts. If you feel that your current role is too cushy and you’re eager for new challenges, exploring new opportunities could lead to personal and professional growth. Just ensure that you do thorough research on any potential employer and the specific roles to make an informed decision. Good luck!