Is DIY Bookkeeping the Right Choice for My Restaurant Chain?

Managing the financial records of your business is crucial, yet it seems increasingly challenging to find reliable Bookkeeping services. As a restaurant owner with four LLCs under the same brand, you’ve experienced the frustration of going through six different bookkeepers over nine years, only to be let down time and again. Some were inconsistent, others disappeared entirely, yet all of them left you with a lighter wallet. Even a trusted CPA turned out to be unreliable, and a recent experience with a Bookkeeping firm, Bench, fell short as they lagged nine months behind.

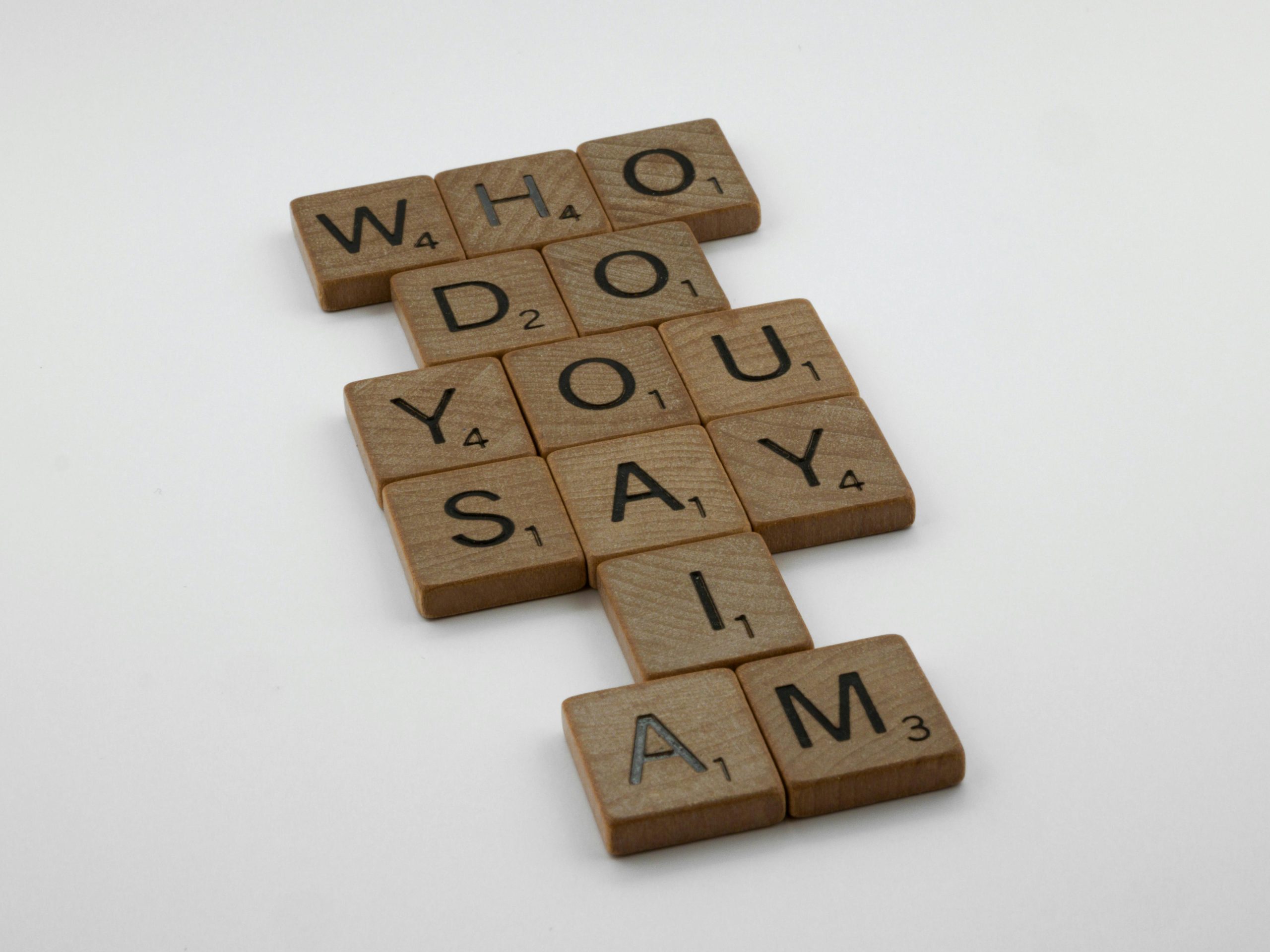

This consistent disappointment has led you to contemplate taking control of your bookkeeping. You find yourself at a crossroads, considering whether it’s possible or wise to manage this aspect of your business yourself, especially without prior experience. Before you embark on this financial journey, there are several vital considerations to weigh.

Should I Tackle Bookkeeping Myself?

Becoming your own bookkeeper could be empowering, as you gain complete control and visibility over your finances. However, it’s essential to realistically assess your ability to swiftly acquire the necessary skills and dedicate the required time. Bookkeeping is not without its complexities, and a learning curve is inevitable.

Time Commitment: What to Expect

One of the primary concerns is how many hours you would need to allocate each week. The time commitment can vary significantly based on the volume of transactions, the complexity of your business activities, and the efficiency of the systems in place. It’s crucial to prepare for this additional workload on top of managing your existing operations.

Choosing the Right Software

The next step is selecting the right software to facilitate the bookkeeping process. There are various options tailored to different needs and budgets. QuickBooks, Xero, and FreshBooks, among others, are popular choices. Assessing their features will help determine which aligns best with your business model.

Managing Multiple Locations

Given that you have four distinct LLCs, understanding the setup of your software will be crucial. Will you need separate subscriptions for each entity, or is there a way to streamline this process with a single platform? Clarifying this will prevent unnecessary expenses and confusion.

Potential Pitfalls and Unknowns

Finally, anticipate possible challenges that might arise. Lack of specialized knowledge could lead to errors in financial reports, missed tax deductions, or compliance issues, all of which could have costly repercussions. It’s essential to be aware of what you don’t know, and whether these knowledge gaps might cause regret down the

One response

Taking on your own Bookkeeping is a significant decision, especially given your situation with multiple LLCs and past experiences with inconsistent service providers. Here are some key considerations and practical advice to guide your decision:

1. Self-Bookkeeping Feasibility

While taking control of your Bookkeeping could provide better accuracy and immediate access to your financial status, it does come with challenges. Without a background in bookkeeping or Accounting, there will be a steep learning curve. It’s crucial to assess if you’re ready to invest the time and energy required to learn the fundamentals of bookkeeping. Online platforms offer courses that could help, but be prepared for a time commitment upfront.

2. Time Commitment

The time you’d need to spend weekly on bookkeeping varies but could range from 3-6 hours per week per business. Initially, the hours might be higher as you familiarize yourself with the process. Consider whether you can afford this time investment given your day-to-day responsibilities managing the restaurants.

3. Choosing the Right Software

Opt for user-friendly bookkeeping software that provides robust support:

– QuickBooks Online: Widely regarded as an industry standard, it’s user-friendly and ideal for small businesses. It offers integration with various apps you might already be using.

– Xero: Another great option known for its intuitive interface and strong support network.

Both platforms offer tutorials and customer support to assist newcomers in navigating their systems.

4. Managing Multiple Businesses

You may need separate subscriptions for each LLC based on the separation of finances and record-keeping policies for legal entities. Some software providers offer discounts for multiple accounts, so it’s worth discussing this directly with them.

5. Hidden Challenges and Compliance

One area of concern is ensuring compliance with tax obligations and other regulatory requirements. Missteps here can be costly. Ensure you understand:

6. When Professional Help is Necessary

If you opt to handle bookkeeping yourself, it’s still wise to have a professional review your work periodically. This can safeguard against errors and help maintain compliance. You might also find it beneficial to hire a part-time consultant to set you up and provide ongoing support.