Deceased employee W2 amendment created negative payroll liability – Help?

Managing Payroll Liabilities Following the Loss of an Employee: Navigating Amendments and Adjustments Losing an employee is[…]

Software recommendation needed – receipt tracking for a small-ish church.

Streamlining Expense Tracking for Small Churches: Affordable Software Solutions Managing finances in a small church can often[…]

What’s the most common bookkeeping mistake you see in construction or trade businesses?

Common Bookkeeping Pitfalls in the Construction and Trade Industries Navigating the financial landscape can be particularly challenging[…]

What’s the most simple bookkeeping software for a self-employed independent contractor (LLC taxed as s-corp)? All I have are (few) expenses and monthly 1099 compensation.

Title: Simplifying Bookkeeping for Independent Contractors: The Quest for the Perfect Software As a self-employed independent contractor[…]

Sometimes you’re just an unqualified therapist who knows Excel – the emotional side of selling

The Emotional Dynamics of Pricing: Lessons from the Field In the complex world of business, particularly for[…]

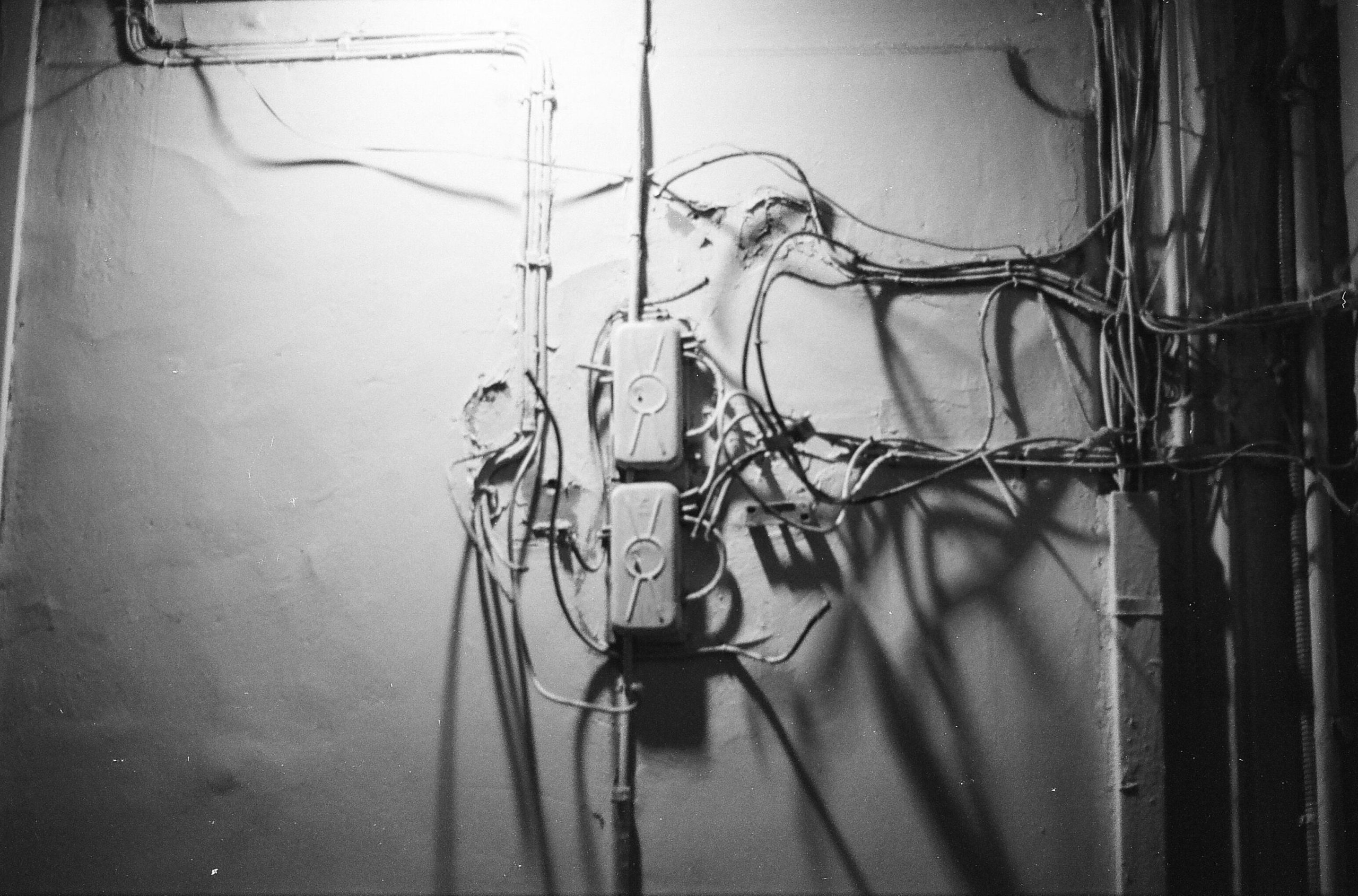

What’s the dumbest way you’ve ever received a document from a client?

The Most Bizarre Ways Clients Have Submitted Documents In the world of client communications, we’ve all encountered[…]

Software recommendation needed – receipt tracking for a small-ish church.

Simplifying Receipt Tracking for Small Churches: Software Solutions In today’s digital age, efficient financial management is essential,[…]

advise regarding a software tool i’m building for an accounting firm.

Enhancing Accounting Software: Seeking Feature Suggestions for Optimal User Experience Hello, fellow professionals! Over the past year,[…]

What’s the most common bookkeeping mistake you see in construction or trade businesses?

Common Bookkeeping Pitfalls in the Construction and Trade Industries As someone who has dedicated significant time to[…]