Salary Expectations and Negotiation Tips for Tax Associate Position (Canada)

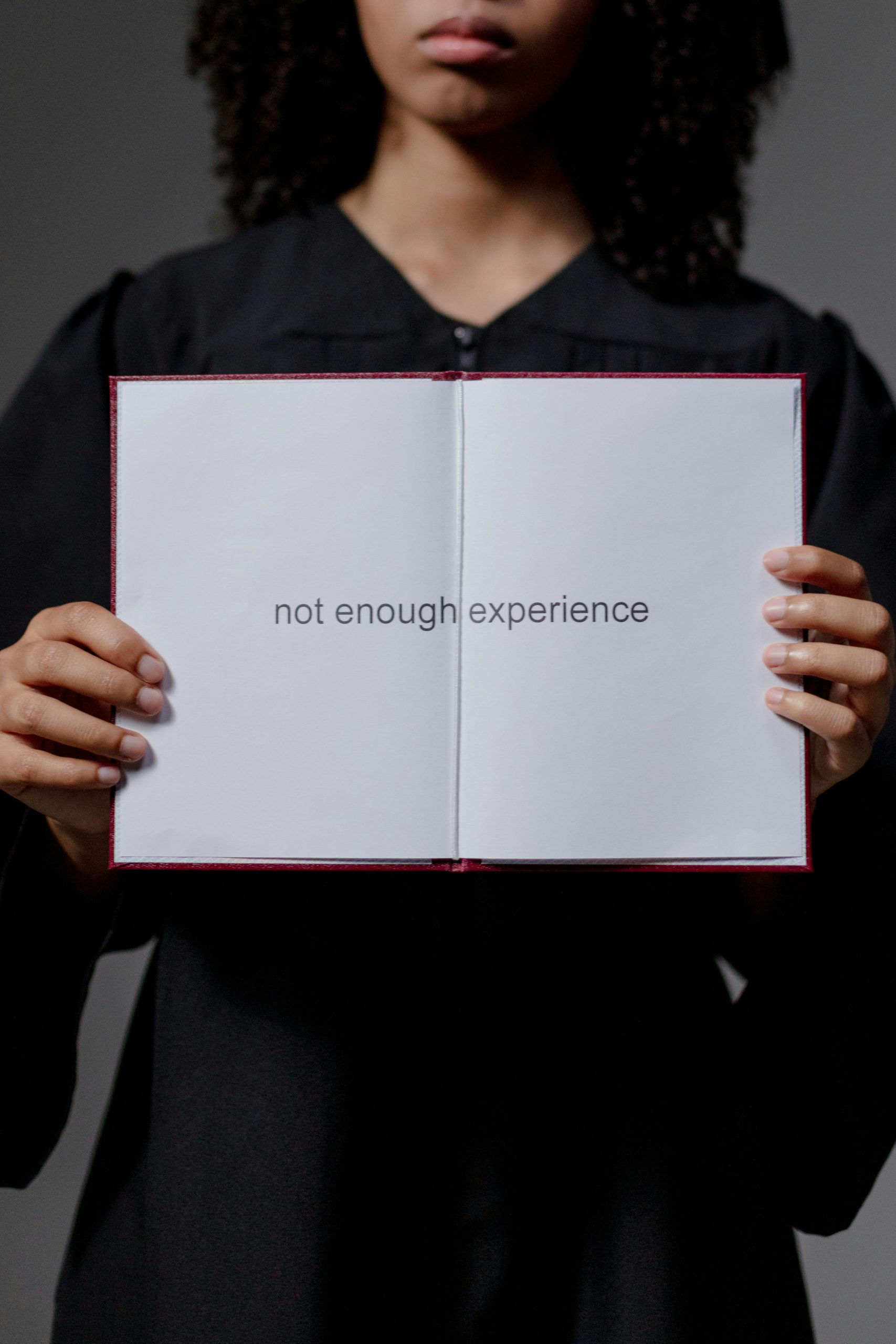

Hello everyone! I recently completed my Master’s in Accounting and am in the process of obtaining my CPA, with just the CFE exam left to tackle this year. I also bring some valuable tax experience from reputable firms to the table, which I feel enhances my application.

Unlike many of my peers, who have had their CPA fees and exam costs covered by their employers, I have personally financed all my tuition, CPA-related expenses, and exams. Now, as I approach the final stages of the hiring process for a Tax Associate position at a midsize Accounting firm, I want to ensure I’m offered a salary that reflects my qualifications.

However, I’ve never been in this situation before and I’m unsure about how to negotiate salary or even how to gracefully accept a job offer. What would be a reasonable salary range for someone with my background? Is it acceptable to request reimbursement for my CPA fees or to negotiate for a higher initial salary?

I would greatly appreciate any advice or tips on how to navigate this process! Thank you!

One response

Congratulations on reaching the final stages of the hiring process for a Tax Associate position! It sounds like you have a solid background and valuable experience that will serve you well in this negotiation.

Salary Expectations

Research Salary Ranges: For a Tax Associate position in Canada, starting salaries often range between CAD 50,000 to CAD 70,000, depending on the firm size, location, and your prior experience. Since you have tax experience and a Master’s degree, you might aim for the higher end of that range, particularly within a midsize Accounting firm.

Consider Location: Salaries can vary significantly based on location. For example, positions in Toronto or Vancouver may offer higher starting salaries compared to smaller cities or towns. Adjust your expectations accordingly.

Leverage Your Unique Experience: Highlight your tax experience from reputable firms, your self-funded CPA journey, and your Master’s degree when discussing your salary. These factors can justify a higher starting amount.

Negotiation Tips

Be Prepared: Before the offer, be ready to discuss your salary expectations. Know the market rates for similar roles in your area and have a figure in mind that you would be comfortable with.

Stay Professional: Approach the conversation from a position of professionalism and gratitude. Show enthusiasm for the role and the firm while discussing your compensation.

Ask About Benefits: In addition to salary, consider negotiating for other benefits, including CPA fee reimbursement. Many firms are open to covering such expenses, especially if it benefits them to have you qualified.

Practice Your Pitch: Practice how you will present your case. It can help to rehearse with a friend or mentor who can provide feedback and help you feel more confident.

Know When to Accept: If the offer is within your expected range and comes with benefits you’re satisfied with, be ready to accept on the spot. If it comes in lower, express your appreciation for the offer, then share your expected range based on your research and experience.

Closing Thoughts

Negotiation can be daunting, especially if it’s your first time, but remember that this is a standard part of the hiring process. Companies often expect candidates to negotiate. Be confident in your abilities and the value you bring to the firm. Good luck!