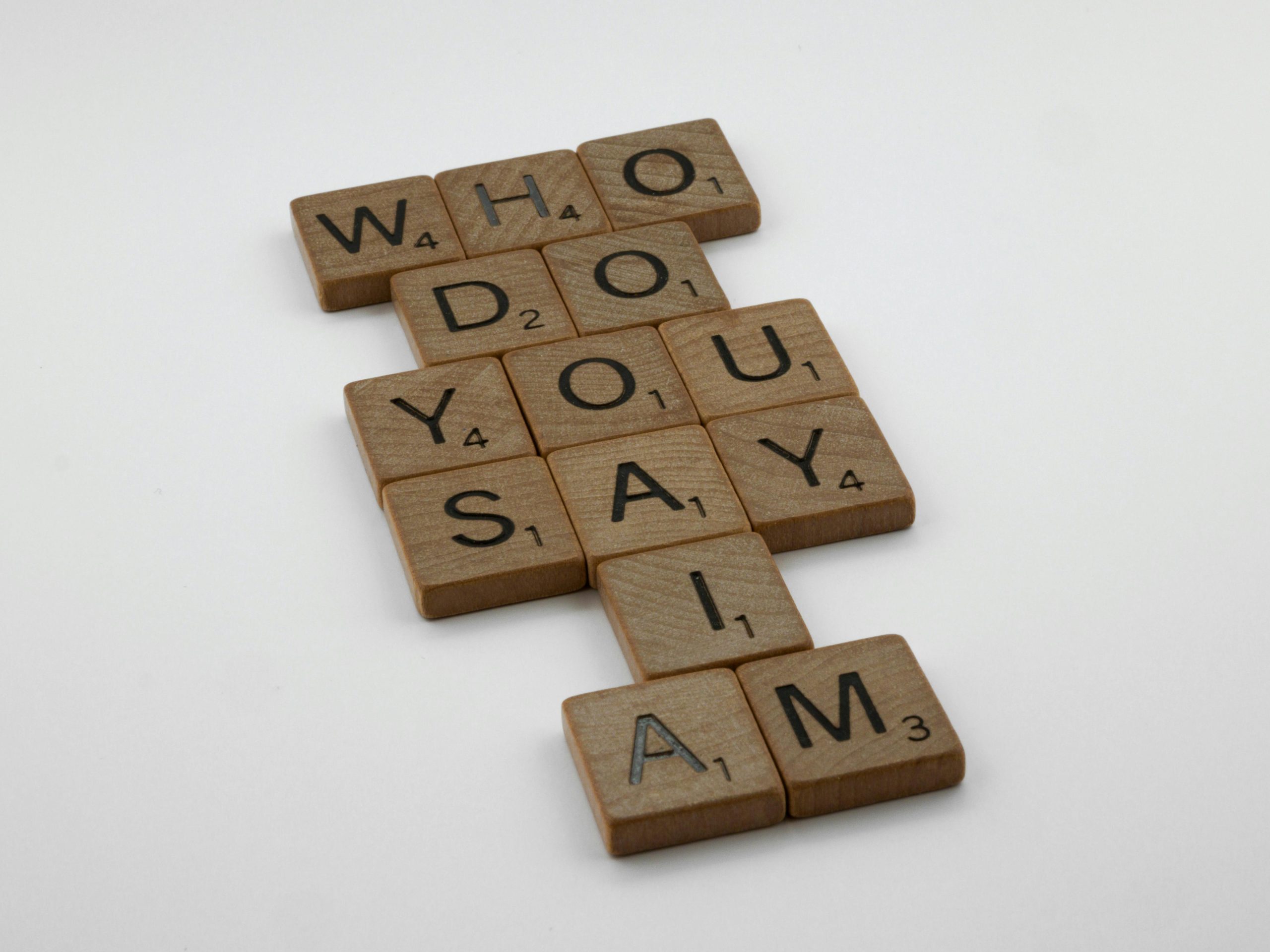

Challenging My Accounting Skills: A Personal Learning Journey

Running the financial side of my business has been my responsibility for several years now. As someone who’s been handling my company’s accounts, I’m looking to deepen my understanding and maybe even take on clients in the future. My aim is to transition from managing my own books to offering professional Accounting services to others.

I invite you to quiz me on my knowledge—beginner to intermediate level questions are welcome. Feel free to toss in a more challenging question for good measure.

Let’s see how much expertise I’ve gathered over the years, purely from personal experience, without the aid of search engines!

One response

It’s fantastic that you’re looking to deepen your Accounting knowledge, both for your own business and to potentially offer your services to others. Let’s dive right into some questions that should cover a range of Bookkeeping concepts from beginner to intermediate levels, and I’ll throw in a challenging one for good measure.

Beginner Questions:

This question tests your understanding of the foundational financial reports every business needs to track its financial health.

Explain the difference between cash and accrual Accounting.

Knowing this is crucial for determining how transactions are recorded, which impacts how income and expenses are tracked and recognized in the business.

What is a chart of accounts, and why is it significant in Bookkeeping?

This speaks to the backbone of your Accounting system, organizing the various accounts your business will utilize for transactions.

Can you define what a journal entry is and provide a basic example?

Intermediate Questions:

Consider what this looks like under both direct write-off and allowance methods.

Explain the process of bank reconciliation and its importance.

This indicates your ability to ensure the accuracy and completeness of your cash records.

What is double-entry Bookkeeping, and why is it important?

Bonus Question: Harder Concept:

For practical advice, as you consider expanding your bookkeeping skills, I suggest joining professional bookkeeping networks or groups online, as these can be a great resource for ongoing education and support. Participating in forums allows you to stay updated on industry trends and tackle complex scenarios collaboratively. Additionally, software proficiency is deemed a significant asset, so investing in industry-standard Accounting Software like QuickBooks or Xero to become proficient can offer a considerable edge when branching out to offer your services to others.

Lastly, remember that bookkeeping is not just about numbers; it’s