Navigating the Tax Profession: The Pathway to Securing a Senior Role

Entering the tax profession can be daunting, especially in today’s landscape marked by a significant talent shortage. As someone who recently ascended to a senior tax position, I’ve learned firsthand about the challenges—and opportunities—this environment presents.

The Importance of Training

One observation I’ve made during my journey is that many tax firms are not fully grasping the necessity of cultivating new talent. There’s a prevalent issue where organizations seem hesitant to invest in training for entry-level professionals, even though they are grappling with a substantial shortage of skilled workers. This creates a paradox: while firms need fresh talent, they often overlook the fundamental step of nurturing it.

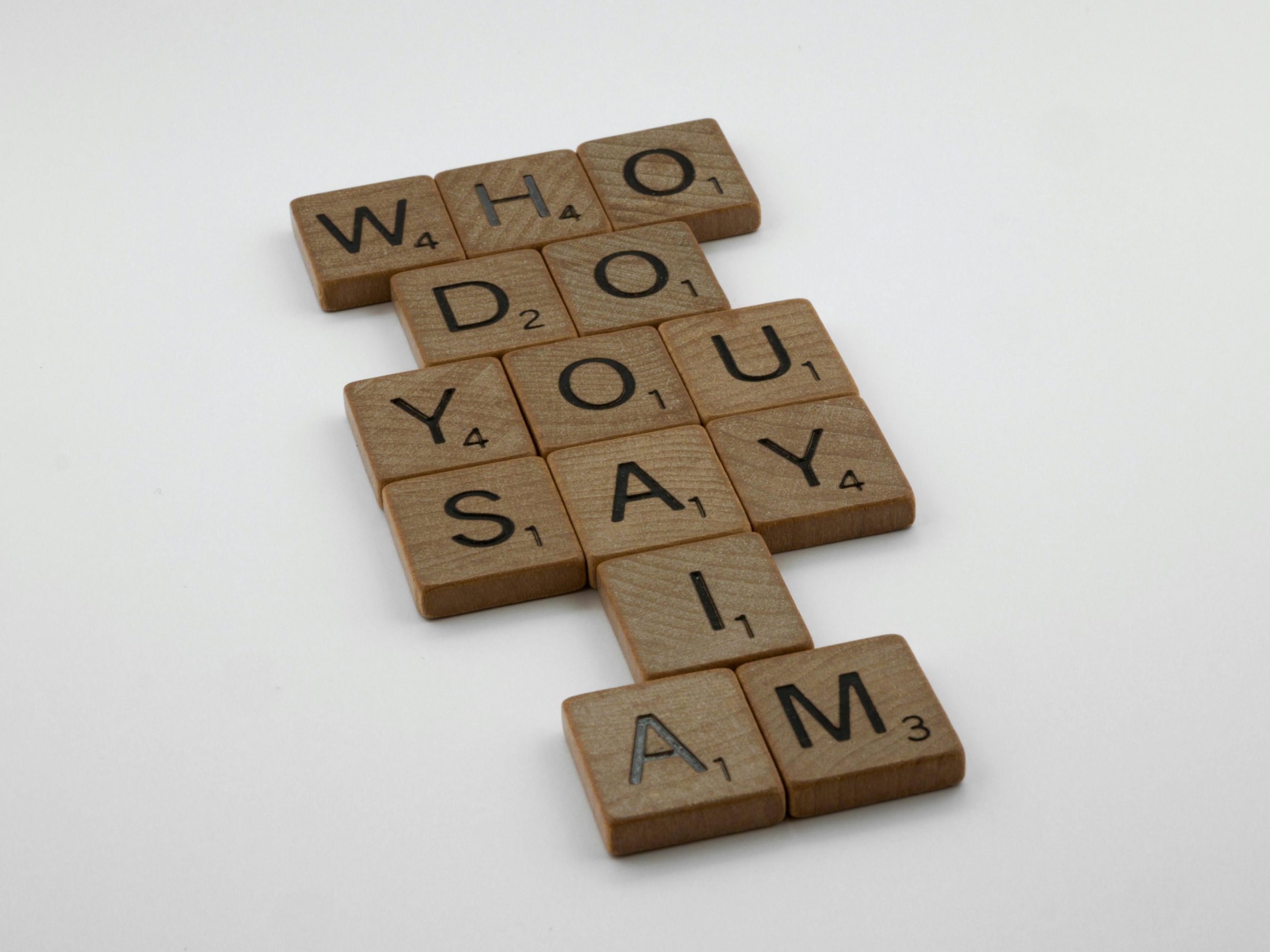

The Art of Persuasion

If you’re aiming to break into a senior role—perhaps as an experienced associate or in a senior capacity—there’s a peculiar skill set that can serve you well. Many candidates feel the pressure to establish expertise right from the get-go, but in reality, demonstrating confidence and a willingness to learn can go a long way in winning over potential employers.

When approaching the job application process, targeting positions with a lower salary range can increase your appeal to firms looking to hire and train new talent. Employers are more inclined to invest in individuals who present as eager learners willing to grow within the organization, especially when you’re upfront about your experience.

Preparing for the Role

Before you step into an interview, a solid review of your Regulation (REG) coursework is crucial. This foundational knowledge will not only boost your confidence but also affirm your capacity to perform in a tax role, even if you feel a bit underqualified initially. If you can showcase a robust understanding of the technical aspects, you’ll set a strong precedent for your capabilities.

Facing the Reality

It’s important to acknowledge that slipping into a role without extensive experience may result in you being “caught.” However, there’s a silver lining. When employers decide to hold onto you despite recognizing your shortcomings, it reflects their acknowledgment of the skills you bring to the table. The nuance is that letting you go would require them to confront their misjudgment during the hiring process. Therefore, they may choose to retain you to protect their own pride and ego.

In conclusion, stepping into the tax profession requires a blend of confidence, strategic positioning, and a willingness to embrace the learning curve. Firms are eager for talent, and those who navigate the hiring landscape with a blend of knowledge and persuasive skill

No responses yet